Buying a home is one of the most significant financial decisions you’ll ever make, and the mortgage process can be daunting. Among the many steps involved, two crucial terms that often come up are mortgage pre-approval and pre-qualification. While these terms are related, they are distinct processes that serve different purposes and provide different levels of information. Understanding the difference between them can help you make more informed decisions as you move forward in your home-buying journey.

In this article, we will dive into the details of both mortgage pre-approval and pre-qualification, explaining what each means, how they differ, and how each can impact your home-buying experience.

What is Mortgage Pre-Qualification?

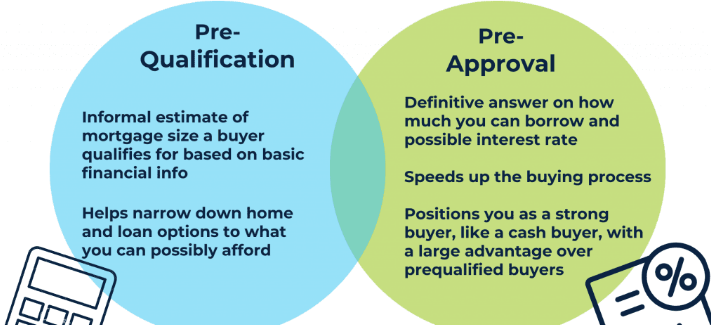

Mortgage pre-qualification is the initial step in the mortgage process. It is essentially an estimate of how much you may be able to borrow based on the financial information you provide to a lender. The pre-qualification process is usually informal and does not involve a detailed investigation into your financial background.

During a pre-qualification, the lender will ask for basic information about your income, debts, assets, and credit. This can be done over the phone, online, or in person, and it often requires only a few minutes of your time. Based on this information, the lender will give you an estimate of how much you might be able to borrow, what your monthly payments could look like, and what interest rates may apply to your loan.

However, the important thing to understand about mortgage pre-qualification is that it is based on self-reported information. The lender doesn’t typically verify the information you provide at this stage. Therefore, the estimate you receive is only as good as the accuracy of your answers. Pre-qualification is useful for giving you a rough idea of your budget and helping you understand what price range of homes you can afford, but it doesn’t provide a definitive commitment from the lender.

Benefits of Mortgage Pre-Qualification:

- Quick and easy: The process is relatively simple and doesn’t require in-depth documentation.

- Good for initial planning: Pre-qualification can give you a general idea of how much you may be able to borrow.

- No commitment: Since pre-qualification is based on self-reported data, it doesn’t bind you to anything, and it is generally free.

Drawbacks of Mortgage Pre-Qualification:

- Less reliable: Since the lender does not verify your information, the estimate is not a guaranteed loan amount.

- No serious assessment of your financial situation: Pre-qualification doesn’t consider the deeper details of your credit score, employment history, or other factors that could influence your eligibility for a loan.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a more formal and in-depth process than pre-qualification. It is a written commitment from a lender that they are willing to lend you a specific amount of money to purchase a home, based on a thorough review of your financial situation. The pre-approval process involves submitting detailed documentation, and the lender will perform a credit check and review your financial history to verify the information you provide.

To get pre-approved for a mortgage, you will need to supply the lender with comprehensive financial information, including:

- Your income (pay stubs, tax returns, or other documentation of earnings).

- Your credit history (a credit report, which the lender will pull).

- Your assets (bank statements, retirement accounts, or other sources of savings).

- Your debt obligations (student loans, credit card balances, car loans, etc.).

Once the lender reviews this documentation and verifies the accuracy of your information, they will provide you with a pre-approval letter. This letter specifies the loan amount for which you qualify, the terms of the mortgage, and the interest rate you are likely to receive. A pre-approval letter typically includes a timeframe in which it is valid (usually 60 to 90 days), after which it may need to be renewed if you haven’t yet purchased a home.

Benefits of Mortgage Pre-Approval:

- Stronger buying position: With pre-approval, you’ll be seen as a more serious buyer by sellers and real estate agents. It can give you an edge in competitive markets.

- Accurate estimate: Since the lender has verified your financial details, the pre-approval letter gives you a much more accurate idea of how much you can borrow.

- Faster closing process: With much of the paperwork already completed, getting a pre-approval can help speed up the loan process once you’ve chosen a home.

- Clear understanding of your budget: Pre-approval helps you shop within your budget, knowing exactly how much you can afford to borrow.

Drawbacks of Mortgage Pre-Approval:

- More time-consuming: The pre-approval process requires more paperwork and may take a few days to complete, as the lender has to perform a more in-depth review.

- Hard credit inquiry: When you apply for pre-approval, the lender will perform a hard inquiry on your credit report, which can temporarily affect your credit score.

- May require additional documentation: Depending on the lender, they may request more documentation as part of the pre-approval process, which could be inconvenient or time-consuming.

Key Differences Between Pre-Approval and Pre-Qualification

While both pre-approval and pre-qualification are steps toward securing a mortgage, there are several key differences between the two:

| Factor | Pre-Qualification | Pre-Approval |

|---|---|---|

| Process | Informal, simple, and quick | Formal, in-depth review of financial documents |

| Documentation | No documentation required (self-reported) | Detailed documentation required (income, assets, debts, etc.) |

| Credit Check | No credit check or soft credit inquiry | Hard credit check performed |

| Approval Status | Estimate of loan eligibility based on self-reporting | Official approval for a specific loan amount |

| Commitment | No commitment from the lender | Written commitment (pre-approval letter) |

| Validity | No expiration, but the estimate may change over time | Typically valid for 60 to 90 days |

When Should You Get Pre-Qualified vs. Pre-Approved?

- Pre-Qualification is a great first step if you are just beginning the home-buying process and want to get a rough idea of your potential loan amount. It’s useful when you are in the early stages of your home search or want to test different scenarios to see what you might be able to afford.

- Pre-Approval is essential once you are ready to make an offer on a home. Sellers and agents typically prefer working with buyers who are pre-approved because it shows that you are serious and financially capable of closing on a home. Additionally, pre-approval can give you a more precise understanding of your budget, which can help prevent wasting time on homes outside of your price range.

Conclusion

While both mortgage pre-qualification and pre-approval play important roles in the home-buying process, they serve different purposes. Pre-qualification is a good starting point that gives you a rough estimate of how much you can borrow based on self-reported information. Pre-approval, on the other hand, is a more formal and in-depth process that provides you with a definitive loan amount, and it can give you a significant advantage in the competitive housing market.

If you’re serious about purchasing a home and want to increase your chances of success, getting pre-approved is the way to go. It shows sellers that you are financially capable and ready to move forward with a purchase. However, it’s always a good idea to start with pre-qualification to get a general sense of your mortgage options before committing to the more formal pre-approval process. Ultimately, understanding the differences between these two can help guide your home-buying journey and lead to a smoother, more efficient experience.