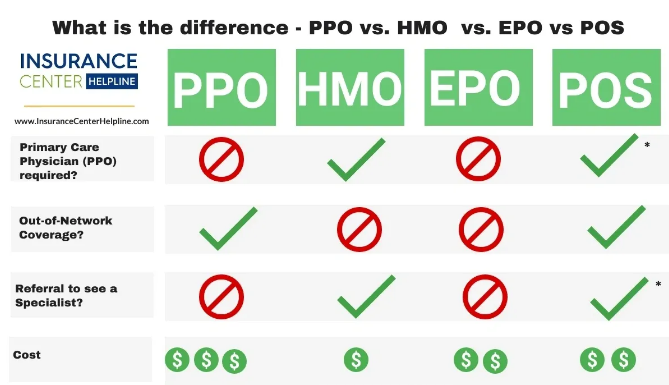

Health insurance can be a confusing and overwhelming topic, particularly when trying to navigate the different types of plans available. Among the most common plan types are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans. Each plan offers distinct features, benefits, and limitations, which can impact the cost, flexibility, and convenience of your healthcare. Understanding the differences between these plans will help you make an informed decision when selecting a health insurance policy.

This article breaks down the key features of HMO, PPO, EPO, and POS plans to help you understand which one might be the best fit for your healthcare needs.

1. Health Maintenance Organization (HMO)

Overview: HMO plans are one of the most common types of health insurance plans. These plans generally focus on cost containment, providing affordable coverage by requiring policyholders to use a network of doctors, hospitals, and other healthcare providers.

How It Works:

- Primary Care Physician (PCP): With an HMO plan, you are required to choose a primary care physician (PCP) who acts as the gatekeeper for your healthcare. Your PCP is responsible for managing your care, including referrals to specialists.

- Referrals: To see a specialist or receive certain types of care (like physical therapy or imaging services), you need a referral from your PCP. This requirement ensures that your healthcare is coordinated and cost-effective.

- In-Network Providers: HMOs typically offer coverage only for services rendered by in-network providers, except in emergencies. If you seek care outside the network, you’ll likely have to pay the full cost of the service.

Pros:

- Lower premiums and out-of-pocket costs: HMO plans are generally more affordable compared to PPOs and POS plans because they focus on cost containment.

- Coordinated care: Since you work with your PCP for all your healthcare needs, your care is more coordinated, which may improve outcomes.

- Preventive care: HMO plans often emphasize preventive care, covering screenings, vaccinations, and wellness visits at no additional cost.

Cons:

- Limited flexibility: You must get a referral from your PCP to see specialists, and you are required to use in-network providers for most services.

- No coverage for out-of-network care: Except for emergencies, if you go out of network, you will generally be responsible for the full cost of care.

Best For: Those who prefer lower premiums, are willing to work with a primary care doctor for referrals, and don’t mind the restrictions of in-network care.

2. Preferred Provider Organization (PPO)

Overview: PPO plans offer greater flexibility than HMO plans by providing a larger selection of healthcare providers and fewer restrictions on referrals. These plans typically allow you to see any doctor or specialist without the need for a referral, and you can choose between in-network and out-of-network providers.

How It Works:

- No referrals needed: Unlike HMO plans, PPO plans don’t require you to get a referral to see a specialist. You have the freedom to make appointments directly with any healthcare provider within the network.

- In-Network vs. Out-of-Network: PPO plans have a network of preferred providers, but they also cover out-of-network care (albeit at a higher cost). If you choose to see an out-of-network provider, you’ll typically pay a higher deductible, coinsurance, and copayment.

- Flexibility: You don’t need a referral to see specialists, and you’re not restricted to in-network providers.

Pros:

- Greater flexibility: You have the freedom to choose healthcare providers without needing referrals.

- Out-of-network coverage: You can seek care from out-of-network providers, though it may come at a higher cost.

- No need for coordination of care: You can see specialists or seek treatments without the approval of your primary care doctor.

Cons:

- Higher premiums: PPO plans generally have higher monthly premiums than HMO plans.

- Higher out-of-pocket costs: While you have more flexibility, seeing out-of-network providers increases your deductible, copayment, and coinsurance, making it more expensive.

- More complex billing: PPO plans often involve more paperwork when seeing out-of-network providers, and you may have to file claims yourself.

Best For: Those who value flexibility, want the freedom to see specialists without referrals, and are willing to pay higher premiums for this convenience.

3. Exclusive Provider Organization (EPO)

Overview: EPO plans are similar to PPOs in that they allow you to see any doctor or specialist within the network without a referral. However, unlike PPO plans, EPOs do not cover any out-of-network care except in emergencies.

How It Works:

- No referrals needed: Like PPO plans, EPO plans don’t require you to get a referral to see a specialist. You can directly access any in-network healthcare provider.

- No out-of-network coverage: EPO plans typically do not cover any out-of-network services except in the case of an emergency. If you see an out-of-network provider for non-emergency care, you will be responsible for the full cost.

- Network restrictions: EPO plans offer the flexibility to choose any provider within the network but have a limited scope of care outside of the network.

Pros:

- Lower premiums than PPOs: Since EPO plans restrict out-of-network coverage, they tend to be more affordable than PPO plans.

- No referrals required: You can visit specialists or other healthcare providers directly without needing a referral from your primary care doctor.

- Flexibility within the network: Within the network, you have a high degree of flexibility in choosing providers.

Cons:

- No out-of-network coverage: If you need care outside the network, you will have to pay the full cost, except for emergencies.

- Limited provider options: EPO plans offer less flexibility in choosing healthcare providers compared to PPO plans, as you are restricted to in-network providers.

Best For: Those who want more flexibility than an HMO plan but are okay with using only in-network providers. It’s a good choice for individuals who primarily use in-network care and don’t need out-of-network services.

4. Point of Service (POS)

Overview: POS plans combine elements of both HMO and PPO plans. Like HMO plans, POS plans require you to choose a primary care physician (PCP), but like PPO plans, they allow you to see out-of-network providers for a higher cost. POS plans are a hybrid of these two types, offering a balance of flexibility and cost-effectiveness.

How It Works:

- Primary Care Physician (PCP): Just like HMO plans, POS plans require you to designate a primary care physician (PCP) who manages your care and provides referrals for specialist visits.

- Referrals: You’ll need a referral from your PCP to see a specialist or receive specialized care, similar to the structure of an HMO.

- Out-of-Network Coverage: POS plans allow you to seek care from out-of-network providers, but it will cost more than using in-network providers. You may need to pay higher coinsurance or copayments for out-of-network services.

Pros:

- Lower premiums: POS plans generally have lower premiums than PPO plans.

- Out-of-network coverage: You have the option to see out-of-network providers, though it will cost more.

- Coordinated care: Your PCP manages your care, ensuring better coordination and efficiency in treatment.

Cons:

- Referral requirement: You must get a referral from your PCP to see a specialist, which may limit your flexibility.

- Higher out-of-network costs: If you choose to see an out-of-network provider, you will face higher costs compared to in-network providers.

Best For: Those who want a balance between cost and flexibility, particularly if you’re willing to coordinate care through a primary care physician but want the option of seeing out-of-network providers at an additional cost.

Conclusion

Choosing the right health insurance plan involves understanding the differences between HMO, PPO, EPO, and POS plans. Each type of plan offers distinct advantages and disadvantages, depending on your healthcare needs, preferences for flexibility, and budget.

- HMO plans are ideal for individuals who want the most affordable coverage and are comfortable with coordinating care through a primary care physician.

- PPO plans provide the greatest flexibility, allowing you to see any provider without referrals, but they come with higher premiums and out-of-pocket costs.

- EPO plans offer a middle ground by providing flexibility within the network but excluding out-of-network care except for emergencies.

- POS plans combine aspects of HMO and PPO plans, offering coordinated care through a PCP and the option to see out-of-network providers for a higher cost.

When selecting a health insurance plan, consider your healthcare needs, budget, and how much flexibility you require in choosing providers. Understanding these key differences will help you make a more informed decision and find the plan that works best for you.